If you have been impacted by Hurricane Ida in Louisiana, we are here for you. We will assess the extent of your hurricane damage, estimate how much your case is worth and fight to fully cover damages and losses suffered. Call Now (504) 888-2227 or Use Our Contact Form

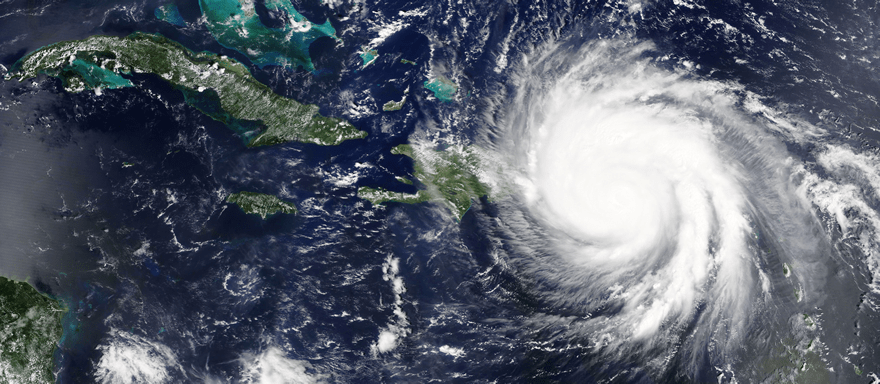

SCHEDULE CONSULTATIONOn August 29th, 2021, Hurricane Ida made landfall as a category 4 storm near Port Fouchon, LA wreaking havoc in multiple areas across South Louisiana with its catastrophic winds, flash floods

and heavy rainfall.

Our region has experienced widespread damages including, but not limited to the parishes of Lafourche, Terrebonne, St. Charles, St. James, Jefferson, Orleans, Plaquemines, St. Tammany, Tangipahoa, Livingston, Ascension, East Baton Rouge and more.

The Bayou and River Parishes along with lower lying areas of Jefferson and Plaquemines have

been hit hard. Grand Isle, Houma, Lafitte, New Orleans, and LaPlace, a community adjacent to Lake Pontchartrain are experiencing some of the worst of Ida’s impact.

The damage caused is widespread, and millions have been left without power. The exact extent of

the property damage and insured losses suffered from Hurricane Ida has yet to be estimated.

This devastating hurricane in South Louisiana comes at a time where our state’s residents are still creating a new normal in the wake of COVID-19.

Unfortunately, homeowners and business owners alike may find that their insurance companies underestimate the cost of repair regarding property damage caused by Hurricane Ida and aren’t able to get the compensation they deserve.

We have seen this happen in the aftermath from claims made made as a result of Hurricanes Katrina, Rita, Gustav, Ike, Zeta and Laura just to name a few.

Having a hurricane damage attorney such as one of our skilled team members at Charbonnet Law Firm, though, can make all the difference for you and your family when facing the insurance companies.

We’ve compiled the following details for you to help our residents learn essential information that you should know about the damages hurricanes can cause, how insurance companies handle coverage and property damage in the aftermath of hurricanes and how you can find a hurricane property damage lawyer in New Orleans to help you navigate the entire legal process.

Were you, or anyone you know, affected by Hurricane Ida? Don’t worry! You don’t need to handle insurance companies alone. Our experienced and skilled hurricane damage lawyers out of our New Orleans and Metairie offices are prepared and ready to help you.

We are serving clients all over the state and remain available to assist you by phone and remotely as our communities begin recovery and rebuilding.

All of our attorneys are versed in hurricane insurance recovery and will fight on your behalf to get you the compensation you deserve with the ultimate goal of helping you put the pieces of your life back together in the aftermath of this devastating storm.

It doesn’t matter where in the state of Louisiana you are located. We serve clients all across the state. We will review your insurance policy information and discuss your next steps with you. Ensuring that you and your family get to rebuild is our top priority.

Need Help with a Hurricane Ida Claim? Contact Our Insurance Recovery Team. All of our lawyers were born and raised in the New Orleans metro area. We take pride in providing top legal representation to the community that we call home. We charge nothing for our services unless we recover money on your behalf!

SCHEDULE CONSULTATIONOver the years, hurricanes have ravaged the areas surrounding New Orleans. They are known as some of the most costly and damaging annual natural disasters to hit Louisiana and other states across the United States.

The most common types of damage caused by hurricanes on the Gulf Coast are as follows:

As we are seeing with Hurricane Ida, the 100+ m.p.h winds associated with these devastating storms can leave millions without power.

During the annual hurricane season in Louisiana, residents can be injured physically in the midst of or as a result of the storm. These injuries can include, but are not limited to: broken bones, lacerations, heavy bleeding, water-borne infections, dehydration, burns, chainsaw injuries and carbon monoxide exposure.

Whether this is as a result of the flash floods or amount of rain that falls during the storm, flooding can damage your property, depending on its location, the strength of your property’s structure and additional environmental factors.

Both homeowners and business owners can find extensive property damage following a hurricane. Depending on the severity of the damage, this can cause them to face significant challenges when it’s time to rebuild and restore.

This is certainly a worst case scenario and one we hope never happens during or because of a hurricane. However, it does, sadly, happen. Hurricanes Katrina, in particular, took the lives of many.

Other common types of damage caused by hurricanes could involve: uprooted trees, power line damage, blocked roadways and more. A hurricane damage attorney in Louisiana — or with us at Charbonnet Law Firm — can help you navigate how to best handle these situations.

For more information, or if you have been impacted by Hurricane Ida and have questions pertaining to your specific circumstances, contact our law firm and speak with an attorney.

At Charbonnet Law Firm, our hurricane damage and insurance attorneys understand that hurricane season heightens the anxiety of many property and business owners in and around New Orleans and across the state.

While we can now track pending hurricanes with near precision, we are still unable to predict the exact amount of damage the storm will cause.

We don’t know if, once the hurricane makes landfall, it will remain a Category 4 or when and where it will begin to lose steam.

This unpredictability is what tends to frighten and stress out Louisiana residents the most, sending many from their homes to shelters or elsewhere for safety.

Once the hurricane has passed and everyone is able to return to their homes, they don’t know what they’ll face — if there will be anything left or not. Yet, no matter how moderate or severe the damage, it’s no less devastating for our clients, their families and the community.

Among the most common types of property damage we’ve seen over the years, there can be:

Other common types of property damage could involve: destroyed indoor and outdoor light fixtures, pools, sheds and landscaping; destruction to personal items and household items such as furniture and/or appliances.

There could also be structural damage to your home — the walls, siding, shingles and gutters — and other outbuildings on the property such as detached or attached garages.

Whether your property sustained moderate or severe damage during Hurricane Ida, our top priority is to make sure that you, your family and all other residents are safe.

The same goes to customers, homeowners and business owners who experience property damage that is commercial or business in nature. Your health and safety come first. Assessing the property damage that occurred in the wake of Hurricane Ida, or any other hurricane that sweeps through the state of Louisiana, comes next.

Despite the fact that there is an annual hurricane season on the Gulf Coast, and many residents have implemented safety measures to protect themselves and their properties, sadly not all damage suffered can be prevented. Serious structural devastation can still ensue.

If this is similar to your circumstances in the wake of Hurricane Ida, all hope is not lost. There are some important steps you can take to ensure that your hurricane damage attorney is in the best position to help you, and that you’re set up for success when you file with your insurance company.

These four essential and helpful steps are as follows:

We charge nothing for our services unless we recover money on your behalf!

SEE HOW MUCH YOUR CASE IS WORTH

Now that we’ve explored the essentials surrounding the loss you may have experienced as a result of Hurricane Ida, and you’ve become aware of the different types of damage and how to protect yourself, it’s time to delve into the world of insurance.

Once the storm passes, you’ll want to file a claim with your insurance company and begin the journey to restoring your property and life back to some semblance of order. However, if you aren’t familiar with how insurance companies operate, or have never had to file a claim of this nature, you’ll want to pay close attention to the following segments.

Whenever a strong hurricane hits — no matter what category it is — it’s vital for all property owners, such as yourself, to feel confident that your claims will be quickly processed and that you’ll receive adequate coverage from your insurer after the storm. To do this, there is some important info for you

to keep in mind.

In an ideal world, property insurance companies operate with good faith and keep your best interests in mind. This allows everything to go smoothly, and for all policyholders to get the compensation they deserve, which, in turn, permits them to efficiently rebuild.

Unfortunately, as you are probably all too painfully aware, it rarely works this way. Insurance companies avoid granting you an appropriate payout, particularly when losses suffered by a hurricane in New Orleans are on the more extreme side of things.

If you’ve ever been subject to this response from your insurance provider, our hurricane insurance claim attorneys can help you get the cash payout that you are entitled to and deserve.

What’s more, our experienced damage and insurance claim attorneys at Charbonnet Law Firm can help you resolve any and all disputes with your insurer, so that you can secure proper coverage for damages suffered as a result of the storm.

Here’s a secret that your insurance company won’t tell you, and that you won’t know unless you seek the assistance of a hurricane damage attorney. It’s that you have a legal right to an independent appraisal that assesses the damage caused during a hurricane — or, in this case, Hurricane Ida.

That’s right! You are entitled to know the extent of the damage the storm caused to your property through an independent appraisal.

Another secret. This legal right remains in place even if you’ve already begun receiving payments

from your insurance company. So, it’s certainly worth taking the time to discuss this with an experienced hurricane damage attorney in New Orleans, as this might get you additional compensation in the long run.

They can be your best resource, and most efficient way of resolving any and all disputes that hold your insurance company accountable to their actions. This, in turn, can prevent you from wasting unnecessary and precious time and energy fighting it yourself.

As aforementioned, when it comes to dealing with insurance companies, we are far from living in an ideal world where they operate honestly and fairly. In fact, it’s not uncommon for insurance companies to take advantage of their policyholders to avoid providing you the compensation you deserve after a devastation event such as Hurricane Ida.

Insurance company team members are well aware that hurricanes cause billions of dollars worth in damage through the state of Louisiana every year, but still use deceptive tactics that leave you, your loved ones and your fellow community members in a very compromised, stressful situation.

This is actually illegal and what’s known as your insurer “acting in bad faith.”

It’s important to note that you have legal rights and options. When you sign a policy with an insurance company, you are entering a legal contract together that agrees to specific rules and payments.

Your insurance company is legally obligated to honor the agreement to cover certain services — such as damage caused by Hurricane Ida.

Anytime that your insurance company does not follow through with something written in your policy, this could be considered an action of bad faith.

Some common examples of bad faith tactics include:

Unless you’re an attorney or well-versed with the legal system, trying to understand Louisiana insurance law and all the ins and outs of the legal process following a hurricane can feel impossible.

In fact, anything pertaining to the legal system can feel overwhelming. Then there’s the drama that often happens when handling the insurance companies themselves.

In short, piercing your life together after a natural disaster is not something that you should handle on your own. This is especially true when it comes to the devastation caused by hurricanes.

If you have been directly impacted by this particular storm in Louisiana and have suffered property damage, personal injury or another issue, you’re already swamped and feeling lost as to how to proceed. Don’t worry. You are not alone.

At Charbonnet Law Firm, our hurricane damage attorneys have the experience, resources & knowledge required to take on your insurance company and everything else involved in Hurricane Ida’s aftermath.

We are equipped to combat the deceptive practices and scare tactics your insurer will use to intimidate you and undervalue your claim.

We will advocate for your rights and have your best interests in mind every step of the way. With our help, you won’t have to stress over the legal and financial details.

Instead, you can focus on keeping you and your family safe, while planning out how to get your life back into place and fix your property.

There are many other benefits a hurricane damage attorney in New Orleans can provide as well.

To name a few, an experienced hurricane insurance or damage attorney can:

The Charbonnet Law Firm team is composed of attorneys all born and raised in the New Orleans area who are well-connected and respected within the community.

Our dedicated and highly-trained team members have helped our firm receive millions of dollars in settlements for clients since we first opened.

With three generations of representing injured clients across New Orleans and the surrounding areas, we are equipped to fight for you.

When it comes to handling cases that require thorough research and medical experts, our law firm focuses on complex injury cases and takes a collective team approach. Our hurricane damage attorneys are prepared to help and even go to trial, should this become necessary.

If you, or a loved one, has been impacted by Hurricane Ida in Louisiana, we are here for you. We will assess the extent of your hurricane damage, estimate how much your case is worth and fight to fully cover damages and losses suffered. We will also discuss all of your legal options with you to ensure that you make the best decision for you and your family.

With over 50 years of legal experience serving families in New Orleans and the surrounding Louisiana communities, Charbonnet Law Firm provides our clients with personalized legal services. If you have been personally affected by Hurricane Ida or know of someone else who has been, please don’t hesitate to contact us. Our team remains available by phone and virtually to help you during this difficult time. Contact one of our hurricane damage lawyers today.

SEE HOW MUCH YOUR CASE IS WORTH